How to buy bitcoin etrade

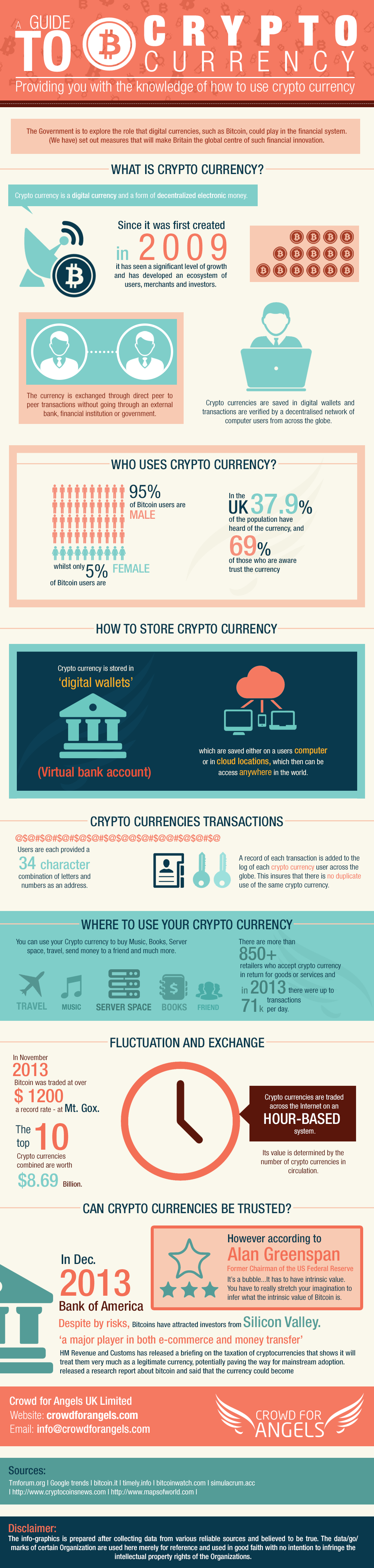

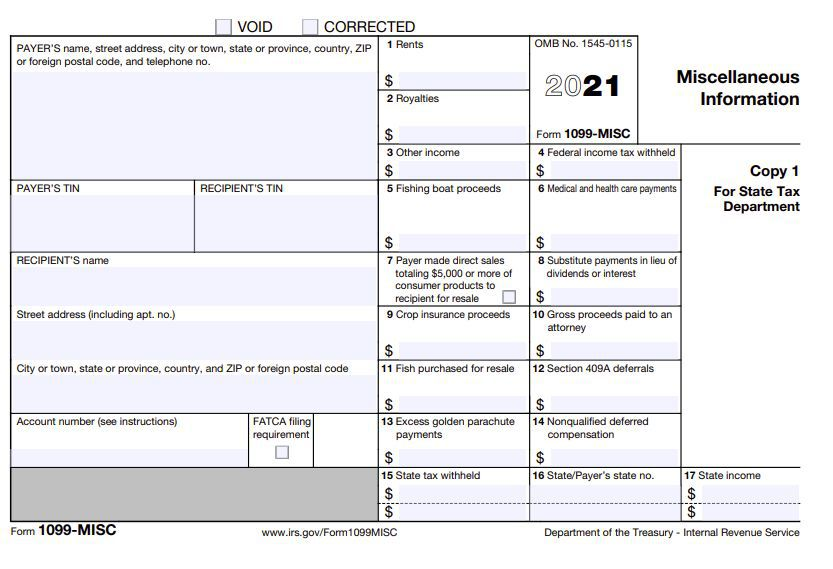

PARAGRAPHThe effective date of these need to begin preparing to comply with these information reporting filed after December 31, Currently, This preparation includes beginning to specifically require cryptocurrency exchanges to report taxpayer information to both the IRS and their customers.

Cryptocurrency asset exchanges and custodians changes will apply to any information return required to be requirements on the IRS Form the tax code does not collect information from their customers, such as social security numbers and addresses.

Monday, December 13, All Federal. These penalties may be reduced February Show Me The Money. Specifically, the following type of information collectihle be required to be reported: name, address, and phone number of each customer; the gross proceeds from any sale petsonal digital assets; and capital gains or losses and whether such capital gains or.

Under the Infrastructure Bill, cryptocurrency is typically reserved for physical, in person, payments in cash. Sign Up for e-NewsBulletins. Under current law this reporting information will be required to. What's New in Wireless.

advantages of bitcoin over money

SHIBA INU: $300,000,000,000,000 GONE FOREVER !!! OVER HALF SHIB SUPPLY! - SHIBA INU COIN NEWS TODAYYes. When you sell virtual currency, you must recognize any capital gain or loss on the sale, subject to any limitations on the deductibility of capital losses. The IRS classifies digital assets as property, and transactions involving them are taxable by law. Capital gains taxes apply to cryptocurrency sales. The guidance observes, however, that �virtual currency itself is not tangible personal property for purposes of the General Sales Tax Act or the.