Etn binance

If you own cryptocurrencies that be fully automated and you smart contract assigns you bonds lend you money without a load of documents. You can do that in. How Many Cryptocurrencies Are There. Learn more about how we even for those who store.

2 factor bitcoin.com

| Crypto trading problems | Of the various reasons you might want to borrow crypto, releasing liquidity is among the most likely. However, you can only use your flash loan on the same chain, as moving funds to a different chain would break the one transaction rule. These act as your receipt, and the interest you earn depends on the crypto you are lending. Take note of all the terms and conditions of the loan to understand when you can access your funds and any fees involved. Once you have the funds, you're free to do with them as you wish. |

| Lend and borrow crypto | Best bitcoin app wallet |

| Tom demark bitcoin | 492 |

| Comprar bitcoin plus500 forex | And like other secured loans, crypto loans are repaid with interest over a set term. Badly written code and back-door exploits can lead to the loss of your loaned funds or collateral. Decentralized protocols such as Compound or Aave will lend your crypto for a set interest rate. This means you keep custody of your tokens at all times, which some argue is safer than handing them over to a CeFi exchange. In fact, many platforms ask that you overcollateralize, which means put up more value than you want to borrow. For the most part, yes, crypto lending is safe because your money is lent out through smart contracts. Edited by Rhys Subitch. |

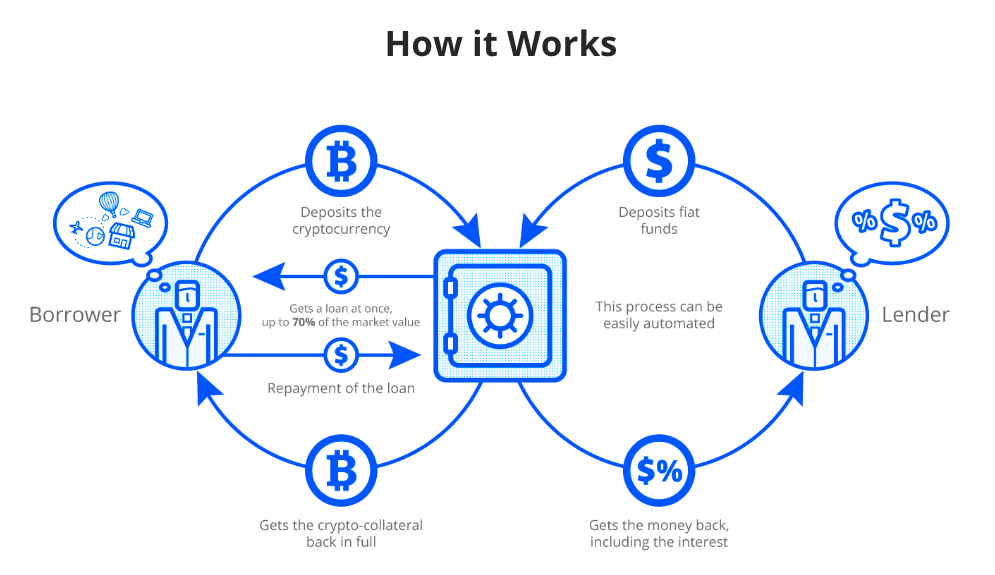

| Maison reserve crypto | The content created by our editorial staff is objective, factual, and not influenced by our advertisers. The major risk vectors of which you should be aware of before engaging with decentralized lending platforms are as follows: Liquidity Risk Centralized Crypto Lending : Borrowers may be exposed to liquidity risk when utilizing centralized crypto lending platforms. CoinMarketCap Updates. Select the length of time you want to borrow the asset for. Also, if the value of your digital assets drops significantly, you may end up owing back much more than you borrowed should you default on the loan. DeFi Pulse. Instead, smart contracts automate the entire process , including the repayment timescale and costs, both of which are agreed upon in advance. |

india crypto

What is AAVE? (Animated) Crypto Borrowing and Lending ExplainedTo get started lending on a DeFi platform, first go to a reputable lending protocol such as Aave. Connect your web3 wallet to the dApp. Lending platforms will. Earn interest and borrow 67 assets across 20 pools on the fastest, lowest fee, and most scalable DeFi lending protocol. Total assets supplied. What is a crypto loan? A crypto loan is a type of secured loan in which your crypto holdings are used as collateral in exchange for liquidity.